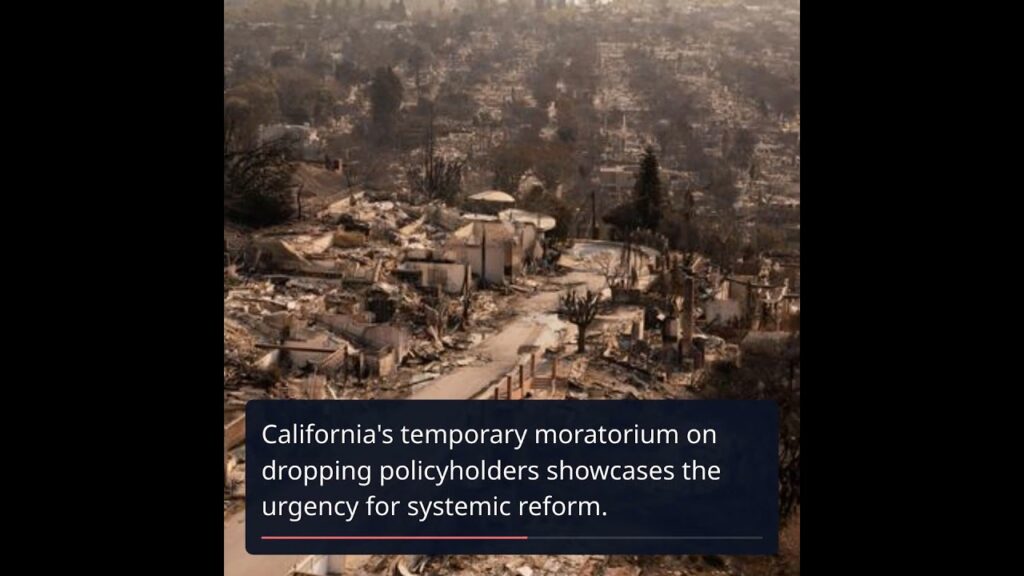

As wildfires rage on, discover how climate change is reshaping homeowners’ insurance and why a crisis looms.

California’s wildfires are a stark reminder of how climate change disrupts home insurance accessibility.,These devastating fires have caused estimated damages up to $250 billion, reshaping the economic landscape.,Insurance premiums have skyrocketed nearly threefold since 2001, particularly in high-risk areas.,Many insurers are abandoning high-risk regions, making it nearly impossible to secure mortgages without insurance.,The insurance sector is at a tipping point, with the climate crisis intensifying the insurance gap.,California’s temporary moratorium on dropping policyholders showcases the urgency for systemic reform.,Adopting a societal approach to insurance can mitigate costs and protect communities from disasters.,Reforming how we build homes and infrastructure could lessen future disaster impacts significantly.,Encouraging relocation with state support may be crucial for those in disaster-prone areas moving forward.

#ClimateCrisis, #InsuranceReform, #Wildfires, #ClimateChange, #HomeInsurance

source

As we navigate this insurance crisis, don't forget to unwind with some relaxing music—check out our Bio!